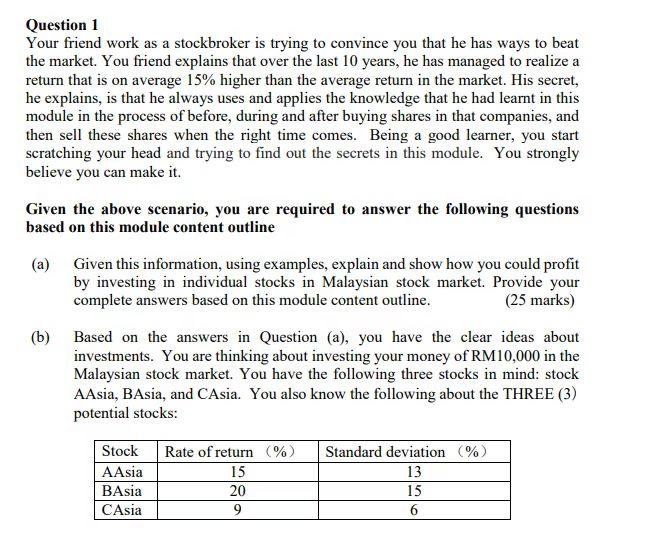

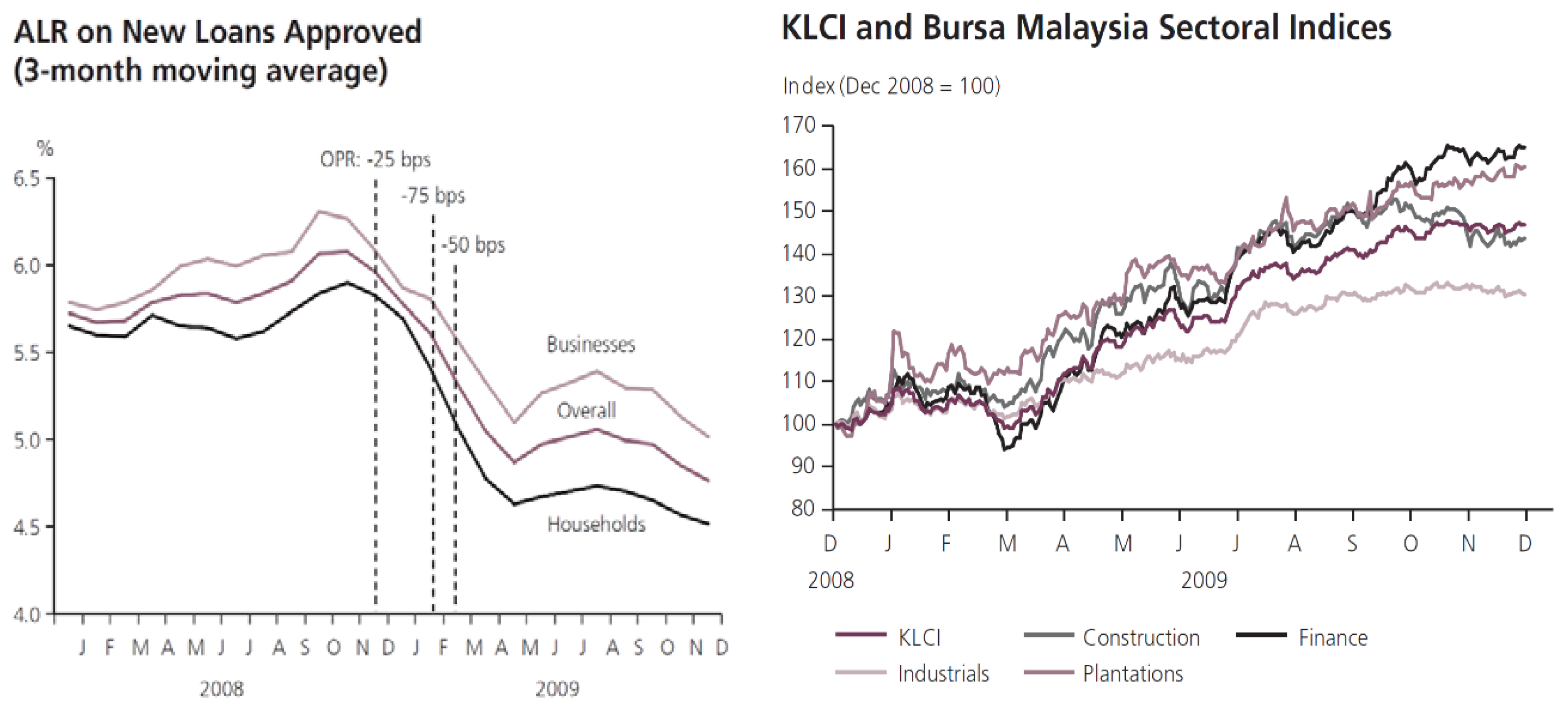

This records a decrease from the previous number of 3109 pa for 2015. Treasury bills are offered in multiples of 100 and in terms ranging from a few days to 52 weeks.

The Malaysia 10Y Government Bond has a 4027 yield.

. 3 to 6-mth abv. Risk premium on lending lending rate minus treasury bill rate in Malaysia was reported at 17733 in 2016 according to the World Bank collection of development indicators compiled. Blow are the 91-day Treasury Bill Average Rates for the year 1994 to date.

Tenure less than one year. No credit risk as issued by the government. Treasury Bills and Bank Negara Bills.

Malaysian treasury bills mtb and malaysian government securities mgs are short term and long term papers issued on conventional basis by the malaysian. 6 Sep 2022 515 GMT0. View and download daily weekly or monthly data to help your investment decisions.

21 rows Short-Term Bills. Malaysia 10Y Bond Yield was 403 percent on Wednesday September 7 according to over-the-counter interbank yield quotes for this government bond maturity. Malaysian Treasury Bills MTB MTB are short-term securities issued by the Government of Malaysia to raise short-term funds for Governments working capital.

KUALA LUMPUR Dec 8. Issued by BNM on behalf of Government and traded on a discounted basis. COUNTRY MALAYSIA.

Our revolutionary technology changes the way. The Malaysian government will issue RM1 billion worth of Treasury bills on Thursday Dec 9. Stay on top of current and historical data relating to Malaysia 3-Month Bond Yield.

MITB are usually issued on a weekly. High liquidity in secondary market. Exchange Rates Sep 06 2022.

Type of Bills Up to 3-mth abv. According to the Bond and Sukuk Information. Malaysian Treasury Bills MTB MTB are short-term securities issued by the Government of Malaysia to raise short-term funds for Governments working capital.

The yield on a Treasury bill represents the return an investor will receive by holding the bond to maturity. Malaysian Islamic Treasury Bills MITB MITB are short-term securities issued by the Government of Malaysia based on Islamic principles. Pin Page Risk premium on lending lending rate minus.

Bills are typically sold at. Traded in multiples of RM10000. 6 to 12-mth For any.

Bills are sold at discount. Bills are sold at discount through competitive auction facilitated by Bank Negara Malaysia with original maturities of 3-month 6-month and 1-year. Table 24 Data as at Sept 2018.

Payable at face value on maturity. The Malaysian government will issue RM1 billion worth of Treasury bills on Thursday Dec 9. Discounted rate based on.

Knoema an Eldridge business is the premier data platform and the most comprehensive source of global decision-making data in the world. Get historical data for the 13 Week Treasury Bill IRX on Yahoo Finance. The 91 Days Treasury Bills are debt obligations issued by RBM on behalf of the Government of Malawi for the 3 months either a discount or face value at a competitive auction on a weekly basis.

Knoema an Eldridge business is the premier data platform and the most comprehensive source of global decision. Treasury Bills and Bank Negara Bills Popular. Central Bank Rate is 225 last modification in.

Public Private And The Whole Portfolio View Wealth Management

Jrfm Free Full Text The Good And Bad News About The New Liquidity Rules Of Basel Iii In Islamic Banking Of Malaysia Html

Malaysia Government Securities Indicative Yield Ceic

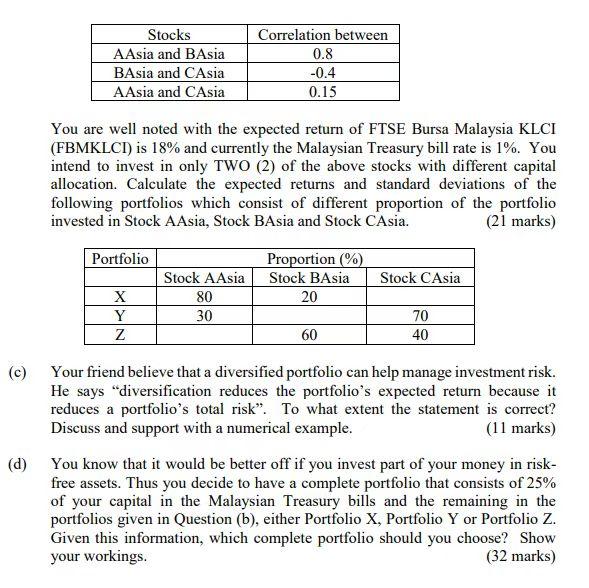

Question 1 Your Friend Work As A Stockbroker Is Chegg Com

Malaysia Treasury Bill And Government Securities Rates Annual Ceic

My10y Price The Government Bond Chart Tradingview

Look Out T Bills There Is A New Kid In Town

Etfs Most Sensitive To Inflation

Question 1 Your Friend Work As A Stockbroker Is Chegg Com

High Bond Yields In Play The Star

Lure Of Malaysia S High Yield Bonds The Star

Jrfm Free Full Text The Good And Bad News About The New Liquidity Rules Of Basel Iii In Islamic Banking Of Malaysia Html

My10y Price The Government Bond Chart Tradingview

How To Calculate The Percentage Return Of A Treasury Bill Nasdaq

Malaysia Government Securities Indicative Yield Ceic

This Time Emerging Markets In Asia Are Better Prepared For Taper Bloomberg

Malaysia Treasury Bill And Government Securities Rates Annual Ceic